2025 Open Enrollment

Information for 2025 started to be provided in May, 2024. As updates become available, this site will be updated.

Quick links:

- May 2024 For Your Benefits Newsletter

- NEW! Must Choose a Vision Plan for 2025

- What’s else is changing in 2025? (TBA)

- Medical Plan Availability by County

- Find a PEBB plan provider

- OE FAQs

- New Vision FAQs

- Presentations (TBA)

- PEBB Medical Benefit Comparison Tool (TBA)

- Benefits Fair info

- 2025 PEBB Medical Benefits At-A-Glance (TBA)

Medical Premium Rates

Presentations (TBA)

WSU HRS Benefits will offer several presentations in the weeks leading up to and during Open Enrollment to help you understand your benefits and any changes that may affect you.

Additional webinars will also be provided by the individual plan vendors and be posted here once those are announced.

Upcoming Sessions: (TBA)

Past Sessions (to be posted as they occur)

Presentation Recordings (to be posted as they occur)

Benefits Fairs

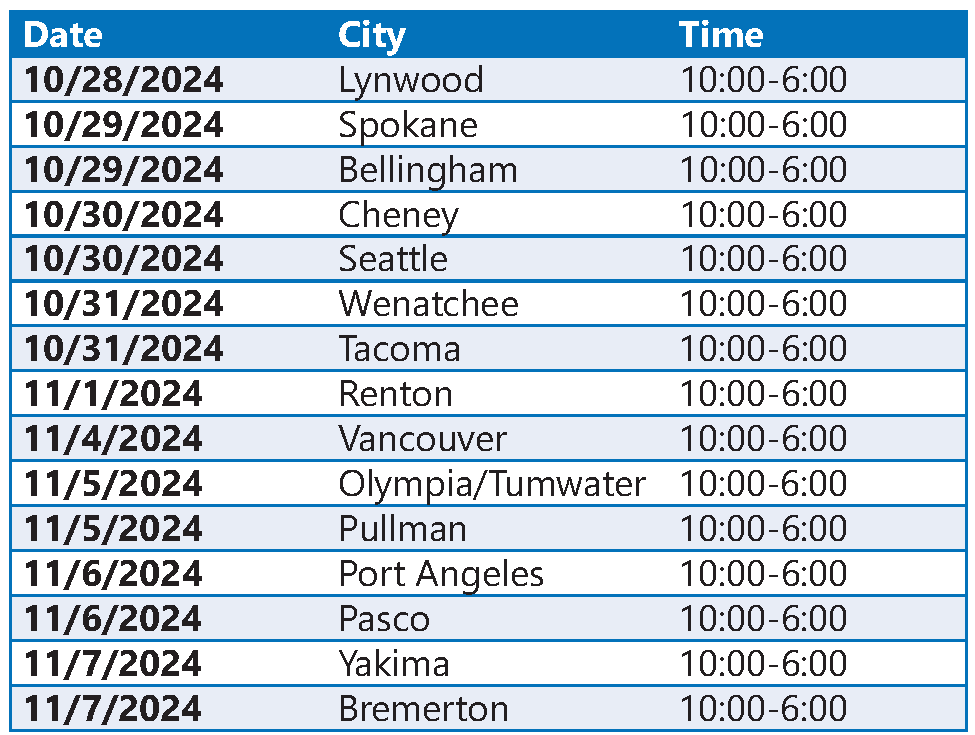

The Pullman Benefit Fair is scheduled for November 5, and will be in the concourse/lobby of the first floor of Lighty Student Services and French Administration.

Following is the full list of fairs state-wide; specific location information will be posted when available..

Open Enrollment Frequently Asked Questions

How do I make the changes to my medical, vision and/or dental plans in Workday?

On October 28, you will receive an Open Enrollment benefits change item in your Workday inbox. You can open each individual coverage type/tile (medical, vision, dental, etc.) and select from the list of plans. Step by step instructions can be found at the JIRA knowledge base.

How can I verify which plan I am currently enrolled in?

In Workday, click on the Benefits & Pay application. Expand Benefits in the left hand column, then select Benefit Elections.

How can I compare coverage between the different medical plans?

PEBB has a medical benefit comparison tool you can use. (This currently displays 2024 information, and will be updated to the 2025 version when available.)

Kaiser Medical insurance premiums increased a lot in 2024. Why are they decreasing in 2025?

Kaiser has stated they have a more favorable outlook in their trends, which is allowing them to reduce their premiums for 2025. HCA has also adjusted how they are determining the employer medical contribution, which is resulting in a reduction in the employee portion of the premiums.

I understand I need to select a vision plan for 2025 during Open Enrollment, and that coverage will no longer be part of my medical plan. Where can I learn more about that?

See the New Vision Benefit FAQs and visit the Vision Insurance website.

How do the UMP/Regence plans work?

UMP covers both in- and out-of-network providers and facilities, with the exception of providers that do not accept patients outside of their own plan network.

If you see a preferred healthcare provider, UMP will pay 85% of the allowed amount and you pay the remaining 15%. Non-preferred providers are covered at 60% of the allowed amount, and you will be responsible for the remaining 40% and anything over the allowed amount.

[If you were to go to a Kaiser NW or Kaiser WA facility, they most likely would not see UMP patients. However, if you do not go to an actual Kaiser facility but see a local doctor who happens to be a Kaiser provider, they most likely are also a UMP preferred provider, or at a minimum would be covered as a non-preferred provider.]

How do the Kaiser NW and WA plans work?

The Kaiser NW and WA plans covers only in-network providers and facilities, with the exception of providers sought for emergency or urgent care with outside the Kaiser network area.

Under these plans, you pay a set co-payment based on the provider you see, with Primary Care Physicians being the lower co-pays, and Specialists being higher. e Kaiser medical insurance premiums increasing so much?” for additional information on why Kaiser submitted a higher premium bid for 2024.

How do I sign up for a primary care provider under the Uniform Plans, and the Kaiser NW and Kaiser WA Plans?

Under the UMP Classic, CDHP and Select Plan, you do not have to name a primary care provider and are able to see anyone listed as a preferred provider. The UMP Plus Accountable Care plans require you to reside in an area where those plans are offered and select a provider in the UMP Plus Network; current counties covered at Benton, Franklin, King, Kitsap, Pierce, Skagit, Snohomish, Spokane, Thurston and Yakima. Chelan and Douglas counties were available in 2024, but no longer will be in 2025.

The Kaiser plans require you to designate a primary care provider. You will not make this election in Workday or via enrollment through WSU, but directly with Kaiser. If you do not choose a physician, Kaiser will match you with one that you can change at any time.

How can I find a health care provider in the UMP/Regence network who would be covered as a preferred provider?

Visit the “Find a Doctor” UMP/Regence website. If you are already a member, log into/sign up for your online account. If you are not a UMP member, follow the links under “For Guests”.

How can I find a health care provider or participating Kaiser NW or Kaiser WA clinic?

For Kaiser NW, visit the Kaiser NW website, and then click on the Doctors and Locations tab. For Kaiser WA, visit the Kaiser WA provider search website. Remember that all locations have a Kaiser WA Clinic, so you can search by provider service or name.

Is Kaiser WA still available on border Idaho counties?

In most of the published documentation, Kaiser WA is not identified a plan available in Idaho. However, Kaiser WA will allow individuals who live on bordering Idaho counties to elect their plan provided they work in a WA County in which Kaiser WA is offered. Technically, Kaiser WA is not listed to be available in Idaho, and it is important to be aware that if you see a provider further from a WA covered county, you would find no Kaiser providers.

If you will retiring soon, please note that starting in 2025 individually contracted providers will no longer be covered by the Kaiser retiree plan. Kaiser will only be covering services provided in a formal Kaiser facility, which are located in Spokane and throughout the west side of the state.

How do I sign up for a primary care provider under the Uniform Plans, and the Kaiser NW and Kaiser WA Plans?

Under the UMP Classic, CDHP and Select Plan, you do not have to name a primary care provider and are able to see anyone listed as a preferred provider. The UMP Plus Accountable Care plans require you to reside in an area where those plans are offered and select a provider in the UMP Plus Network; current counties covered at Chelan, Douglas, King, Kitsap, Pierce, Skagit, Snohomish, Spokane, Thurston and Yakima.

The Kaiser plans require you to designate a primary care provider. You will not make this election in Workday or via enrollment through WSU, but directly with Kaiser. If you do not choose a physician, Kaiser will match you with one that you can change at any time.

If I elect to change my medical plan for 2025, will I be required to switch my dental plan as well?

No. Medical and dental plan elections are separate elections. It would only be if you wanted to change you dental plan as well, that you would need to submit that as an Open Enrollment change. And, remember during the 2025 open enrollment period you will need to elect a vision plan as well, which is separate from your medical and dental plan elections.

What is the amount that WSU pays in addition to what I pay for medical premiums towards my benefits package?

In 2025, WSU will pay a flat $1170 as the employer contribution for each benefit-eligible employee, to cover the majority of the medical premium, all of the vision and dental premiums, and the basic life and long term disability coverage.

How are premium rates negotiated?

WSU’s benefits are part of the state’s Public Employee Benefit package and negotiated at the state level by the Health Care Authority on behalf of all Washington Higher Education Institutions and General Government agencies as a group benefits package.

When negotiating new benefits a rates, the following are reviewed/considered in the negotiation process:

- The submitted bid from the insurance plan to offer the identified benefits for the coming year, with supporting documentation

- Claims experience review – did the claims go up or down during the current period compared to prior periods

- Enrollment shifts – did enrollment go up or down during the current period compared to prior periods

- Projected costs of the insurance usage in the future

- Underlying medical costs and trends

- The benefits being offered are unable to be adjusted for the current year, since that benefit structure has already been established and approved by the State. It could be reviewed/modified in future years, which could have potential impact on the insurance costs.

Vision Benefits Frequently Asked Questions

I understand I need to select a vision plan for 2025, and that coverage will no longer be part of my medical plan. What are the vision plan I can choose from?

Davis Vision by MetLife

EyeMed Vision Care

MetLife Vision

How can I find out what vision plans are available at my location?

The three plans have contracted net-work providers, with a higher level of coverage. In addition to individually contract in-network providers, the following locations are covered:

Davis Vision: In-Network Providers and America’s Best, Costco Optical, Sam’s Club, Visionworks, and Walmart

EyeMed Vision: In-Network Providers and LensCrafters, Pearle Vision, and Target Optical, and many others

MetLife Vision: In-Network Providers and America’s Best, Costco Optical, Pearle Vision, Sams Club, Visionworks, and Walmart

Out-of-network providers will be covered as well at a reduced level of benefit.

Does my medical plan still cover any vision benefits?

Treatment for medical conditions such as infection, eye diseases like glaucoma, and eye injuries will continue to be covered under the medical plans.

What is the vision premium?

Nothing! Like dental coverage, vision coverage is an employer-paid benefit. This means you will not pay a monthly premium for vision coverage.

Do I have to enroll in vision, and what happens if I don’t?

You must enroll or you will be defaulted into the MetLife Vision plan.

Where can I find out more about the vision benefits?

See “New Vision Benefits” under “Quick Links” as well in the October For You Benefit newsletter, and additional WSU announcements and Open Enrollment presentations.

What if I or my dependents have vision coverage under someone on SEBB vision coverage?

You and your dependents can either have all insurance (medical, vision and dental) through your own PEBB coverage, or waive your PEBB coverage and be fully insured (medical, vision and dental) on the SEBB plan. You and your dependents cannot enroll partially in part of the benefits with PEBB and some with SEBB. [SEBB = School Employees Benefits]

What if I have vision coverage under another vision plan?

You can have vision insurance through more than one plan, and those plans would need to coordinate the coverage. The only plans you cannot have dual coverage with is the PEBB and SEBB plans. [SEBB = School Employees Benefits]

Communications (will be added once posted)

- May 22 HCA Publication – For Your Benefit Newsletter

- May 24 WSU Announcement – Changes Coming for 2024 PEBB Benefits

- May 28 – Initial OE Email to Retirees (Emeritus and WSURA groups)